Rule 2: Never spend principal

That's the second rule. Inflation has gone above 10 per cent in the US economy five times, and I'd bet you it will happen again.

Rule 3: Never borrow money to buy a depreciating asset

Almost everybody does this at some point. But as soon as possible, and definitely by retirement, you have to get back to a cash basis.

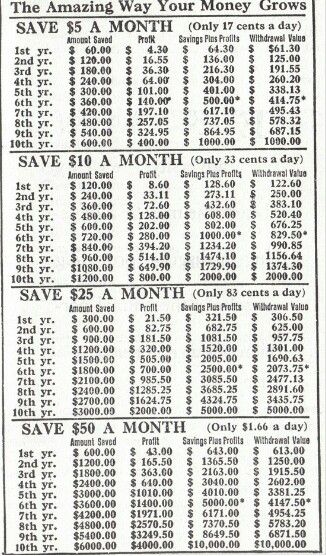

How many people know what a $30,000 car bought on credit costs them at age 25? In retirement dollars, at age 65 and assuming a hypothetical 10 per cent return, that financed car could cost as much as $11,314 a month in potential income. Forever!

So, do you or your children understand what an "investment" in a car really costs you? Yes, I know we all buy cars. But try to imagine what would happen if I got every 25-year-old to forgo just one car purchase and invest that same amount of money in their long-term retirement goals. What a huge difference that could make to their choices at retirement!

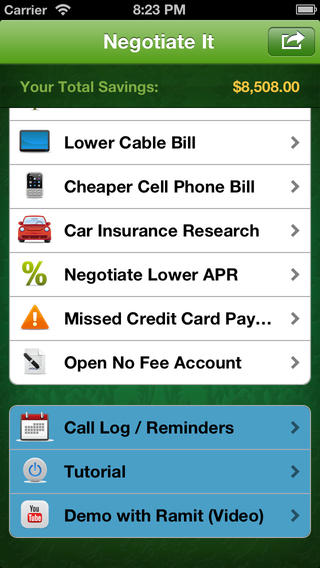

Rule 4: Never save money in a spending account

Keep separate bank accounts for saving and spending. You have to save in savings accounts. If you truly want those savings to grow, use an account that helps you leave the money at work, rather than a "slush fund" that's easy to dip into.

People tell me they are saving $545 a month in an account. Yet when I ask them how much they have accumulated after seven years of doing this, their answer is often $1,123 because they spend out of that same account.

It is not a save-to-save account -- it's a save-to-spend account! If you know you're not naturally a disciplined saver, make it harder to get at the money. You'll be doing yourself a favor in the long run.

Rule 5: Use half, save half

Every time you pay off a debt, get a pay raise, get a bonus, or have any excess cash, have fun with half the money, and put the other half toward your long-term goals.

This is one of the best rules, especially for younger people. By following this rule consistently, in ten years, most people are amazed at how much they can save.

Whether you save or not has nothing to do with how much money you make. Either you save or you don't. It's a habit. Make a habit of investing half of any windfall, big or small, right off the top.

Rule 6: Always use matching money

For example, your employer's 401(k) matching program (in Australia, the employer's matching Providend Fund Contribution, for example).

Do whatever you must to take advantage of matched contributions in a retirement plan. You can't afford not to take the free money.

Hypothetically speaking, if you invest $100 take-home pay in a taxable investment (25 per cent tax on growth) at an assumed 10 per cent return, you would potentially have $135,586 in 30 years (sales charges and fees not included).

If you put the same $100 into your 401(k) that is 100 per cent matched, now you have $150 a month saved because of the tax savings.

Meanwhile your boss adds $150 because of the match -- and it grows tax-deferred, too! Using the same hypothetical return scenario, we have $683,797 to live on -- five times as much wealth with the same work.

Sometimes being smart with our money is a phenomenal advantage. This is a classic example of where investor behavior, not investment performance, makes a huge difference in your long-term wealth potential.

You can hate your boss, or plan to quit, but you must take advantage of the matched money.

Rule 7: Do not spend more than you make

This should seem painfully obvious, but people often have no idea how much they're really spending and what relationship that has to how much they make.In making a budget people often cannot account for 30 per cent of the money they earn and where it goes.

If you are just a little more vigilant, you can significantly enhance your long-term ability to reach your goals.

A budget doesn't happen by accident; it takes practice and is an ever-changing tool in our financial planning. Practice makes perfect. Although "perfect" is never the ideal word for a budget, it does have more meaning and usefulness the longer we practice its use.

Rule 8: Never leave undivided real property to joint beneficiaries

Lots of things are more important than money. Family is probably at the top of the list. If you want a vicious family feud on your hands, breaking this rule would be a great place to start.

Imagine a farm that gets left to four sons: One has farmed it for 20 years; one is an environmentalist and wants it to be a park; one is broke and needs money; and one could not care less about it. Who will get wealthy from this plan? The attorneys. And the kids and grandkids will probably hate each other forever.

Remember that 'equal', 'equitable', and 'fair' are three different words with three totally different meanings.

Rule 9: Never name co-trustees or co-executors of your estate

This one goes right along with the undivided property rule above. Next to poor planning, litigation can be the biggest financial drain on an estate.

Minimize the number of trusted decision-makers, and you'll reduce your chances for litigation. What's more, the entire process will be easier and more efficient with one decision-maker.

Rule 10: Above all --

--Be happy with what you have, and it will lead to both unbelievable financial success and personal (not mere financial) wealth!